-Darren Leavitt, CFA

US Financial markets had another week of consolidation. Equities and US Treasuries sold off in tandem on light volume. An early week debt downgrade of 10 small to midsized banks and a notice that other downgrades may follow by Moody’s dampened sentiment. A characterization that China’s economy is a “ticking time bomb” by the Biden administration coincided with weak Chinese economic data and the announcement that another Chinese developer had missed a debt service and was seeking to restructure its debt. The tail end of Q2 earnings highlighted a decent quarter out of Disney and a weaker-than-expected quarter and outlook from UPS. Economic data for the week was mixed but showed further signs of moderating inflation.

The S&P 500 fell by 0.3%, the Dow added 0.6%, the NASDAQ gave back 1.9%, and the Russell 2000 shed 1.7%. The Tech sector was the biggest laggard this week, while Energy and Healthcare outperformed. US Treasuries yields backed up again as issuance was met with mixed results. The 10-year auction was considered a success, but the 30-year auction on Thursday fell short and helped to push yields higher. The 2-year yield increased by eleven basis points to close at 4.89%, while the 10-year yield increased by nine basis points to 4.17%. Oil prices ticked $0.42 higher, with WTI closing at $83.20 a barrel. Gold prices fell by $30.40 to $1946.60 an Oz. Copper prices tumbled 4% or $0.15 to $3.71 a Lb.

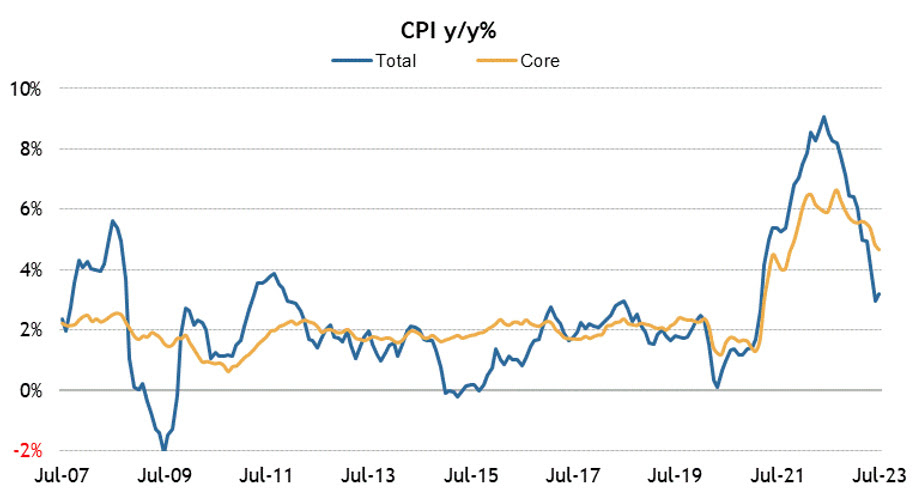

Economic data showed the Consumer Price index in line with expectations on the headline and core readings at up 0.2% in July. On a year-over-year basis, overall CPI increased by 3.2%, up from 3% in June, and the Core reading increased by 4.7%, down from 4.8% in June. Producer Prices came in a little hotter than expected at 0.3% on the headline and core. Initial Claims ticked up 21k to 248k, more than the 230k expected. Continuing Claims fell by 8k to 1.684m. This coming week we will get data on Retail Sales, Industrial Production, Housing data, and Import and export prices.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.